Impact of Corporate Tweets on Investors and Trading Behaviour

Identifying the Issue

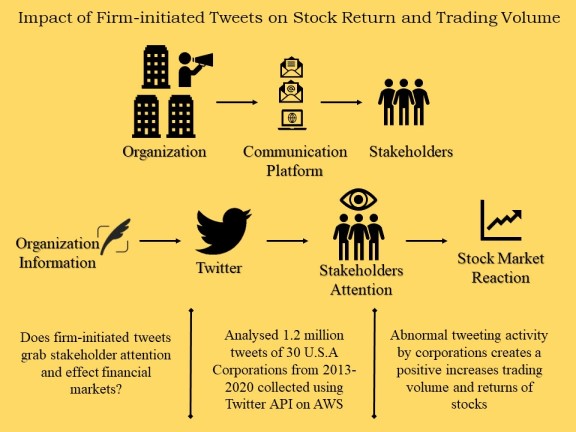

Behavioural finance considers that investors are not completely rational economic agents and are subject to cognitive limitations. About 4266 companies are listed on the U.S stock exchange, and Investors cannot provide equal attention to all the stocks and depend on heuristics and shortcuts. We ask:

“Does firm-initiated tweets grab investor attention and propel them to trade in the stock market”

Objective of the Research

- To create a dataset of the corporate tweets for a sample of thirty large corporations of the U.S.A

- To analyse the relationship between the frequency of firm-initiated tweets and changes in stock returns and trading volume

Who should read this?

Stock market investors, traders, social media managers and corporate communication heads in the U.S.A will find the results valuable

Solution

- Developed an algorithm on R programming language using “rtweet” and “BatchGetSymbols” packages to obtain firm-initiated tweets, stock prices,

and trading volumes. - Countered the API per-user per-day limitation by deploying a task scheduler to run a search query at regular intervals without supervision and executed it on the cloud storage using Elastic Compute Cloud (EC2) provided by AWS Amazon Web Services.

- Examined the relationship between corporate tweeting behaviour and stock price using Vector Autoregression (VAR) model and used Impulse response function (IRF) to quantify the shock on the stock market from Tweets.

We observe that a shock in corporate tweeting behaviour translates into a positive effect on changes in trading volume and returns in 73% and 60% of stocks, respectively

Key Features and Benefits

- The results establishing the association between corporate tweeting behaviour and traded values of return and volume will help corporates strategize the impact of their social media communication on the stock market

- Using corporate tweet frequency, investors can build forecasting models to predict future price movements to earn superior returns

- The study contributes to the scarce literature on the analysis of firm-initiated tweets on volumes and provides researchers the opportunity to examine content analysis on firm-initiated tweets

Impact

A study on the adoption and usage of social media by America’s largest companies, the Dartmouth Center for Marketing Research at the University of Massachusetts, found that Twitter topped the list. Twitter has revolutionized corporate communication and have become important channels for disseminating information.

The association between corporate tweeting behaviour and the stock market opens up great opportunities for corporations concerning corporate information disclosure. It has opened up a new discussion on the power of communication over actions, where social media users give great weightage to tweets and take decisions. In the 21st century, corporations will focus more on tweets to win the corporate war as “A Tweet is mightier than the sword”.

Team

- G Aditya, Research Scholar, Department of Management and Commerce, SSSIHL

- Dr Subramanian S Iyer, Assistant Professor, Department of Management and Commerce, SSSIHL

Title: “Impact of Firm-Initiated Tweets on Stock Return and Trading Volume”

Read Paper Here: https://www.tandfonline.com/doi/full/10.1080/15427560.2021.1949717